In 2020 the world changed

Business Funding Did, Too

Post COVID Funding

Funding for the new normal

The Evolving Landscape

The Evolving Landscape

Underwriting is Uncertain

Lending requirements in both the primary and secondary markets are in a state of shift.

The New Normal

You Need an Advocate

When lenders don’t even know their own current criteria, how are you supposed to? Let us advocate on your behalf.

Underwriting is Uncertain

The world is different, business needs are the same.

On March 13th, 2020, the President of the United States declared a national state of emergency in response to the novel coronavirus pandemic. Six days later, the Governor of California issued the first of what would be many state-wide stay-home orders. In so doing, a chain of events that the modern business world has never seen began. Businesses that were booming on March 1st had their doors locked and their revenue cut to nothing by mid-month. Every single business in America was in some way effected by the pandemic.

What hasn’t changed, however, is that companies need to make good on financial obligations to workers, their supply chain partners, and creditors.

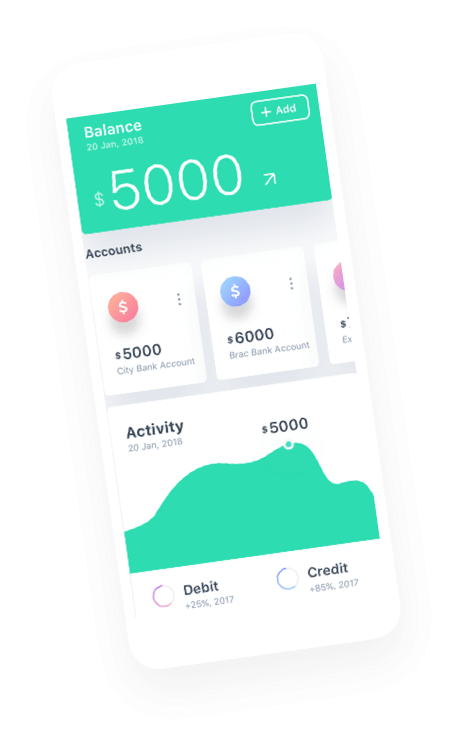

Now more than ever, credit is the lifeblood of our economy. For some small-to-mid-sized businesses, funding will mean the difference between survival and not. For many others, however, access to funding will simply allow their businesses to grow, to produce more goods or provide more services, and to employ more people.

Every business was affected by the pandemic, but not every business needs rescuing. Some just need access to capital and credit to continue operations.

Yes, we are in a new normal. Some things will inexorably change. What likely won’t change, however, is capital access being a key factor to business development, growth, and flourishment.

It’s better to know the HOW than the WHY

We can’t tell you we know what lenders are looking for. They themselves are still figuring it out. When you can’t know the “why”, the “how” becomes indispensable. We know how to present a business. We know how to shop lenders. We know how to speak their language. We know the grueling, tough questions they are likely to ask you, and we can ask them first.

Yes, small and mid-sized businesses can still get capital. Yes you can still get funding for your next stage of growth, or to get you back on track. You just have to know the “how”.

It’s better to know the HOW than the WHY

We can’t tell you we know what lenders are looking for. They themselves are still figuring it out. When you can’t know the “why”, the “how” becomes indispensable. We know how to present a business. We know how to shop lenders.We know how to speak their language. We know the grueling, tough questions they are likely to ask you, and we can ask them first.

Yes, small and mid-sized businesses can still get capital. Yes you can still get funding for your next stage of growth, or to get you back on track. You just have to know the “how”.

Find YOUR new normal

Our team of professionals can help you find your new cashflow equilibrium.

We will look at your individual situation; financial and business history, detailed projections, industry outlook, funding requirements, business volume and other factors. We will challenge your assumptions. We will ask you the hard questions now, when an incorrect answer won't cost you access to the capital your business needs to flourish.

We may recommend pursuing a traditional bank loan, and we can help you shop to the right lenders who are ready to do business. We may recommend that you leverage capital tied up in receivables, and find a factor that meets your business profile. We may match you with a company that specializes in funding businesses based on hard assets. First, however, we'll get to know your business, so we know how to advise you.

Find YOUR new normal

Our team of professionals can help you find your new cashflow equilibrium.

We will look at your individual situation; financial and business history, detailed projections, industry outlook, funding requirements, business volume and other factors. We will challenge your assumptions. We will ask you the hard questions now, when an incorrect answer won't cost you access to the capital your business needs to flourish.